by Flint Adam, Nolensville resident & REALTOR®

On Sunday, March 27th, I began to wonder.

We were wrapping up another insane month of Nolensville real estate sales, but something about that weekend felt different. I had a new listing and knew we would be going under contract that evening, but the number of showings wasn’t as insane as I had become accustomed to.

Over the course of the next two days, I spoke with other agents who had listings around town and the common theme was that all of us had fewer showings than expected. We still got foot-traffic, mind you… we still got offers… but it felt different.

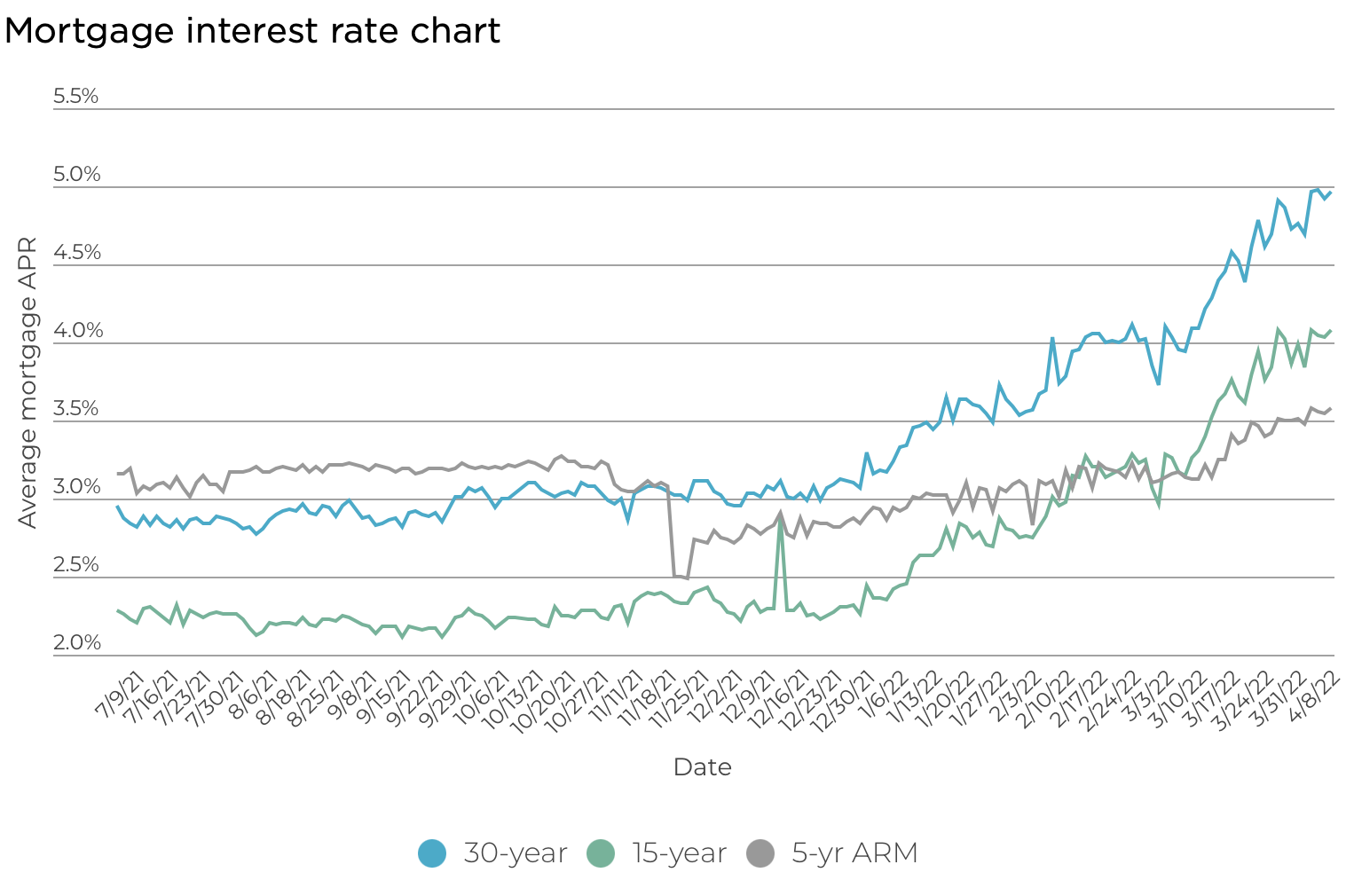

Mortgage interest rates had made a significant jump over the course of that week, and were up about 80 basis points (+0.80%) from the start of the month, now reaching around 4.9% on a conventional 30-year loan. It was a significant change in a short amount of time. (Even more significant when you consider that on December 1st, the 30-year conventional rate was just below 3%.)

I called up my friend Jesse Alvarez, a Nolensville resident and loan officer, to discuss the market. He told me he couldn’t ever remember rates moving up so quickly. I posed a question to him: let’s say you buy an $850,000 Nolensville home with 20% down and great credit. What’s the difference in monthly mortgage at 4% (close to where rates were at the beginning of March), and 5.75% (where rates could possibly wind up later this summer)?

Running simple numbers, he said that a mortgage would look something like $3,245/mo at 4%… and $3,968/mo at 5.75%.

“Wow,” I said.

* * * * * * *

I have no crystal ball. I can’t tell you, with authority, what is going to happen in the real estate market. I can cite data, and I can make educated guesses, though.

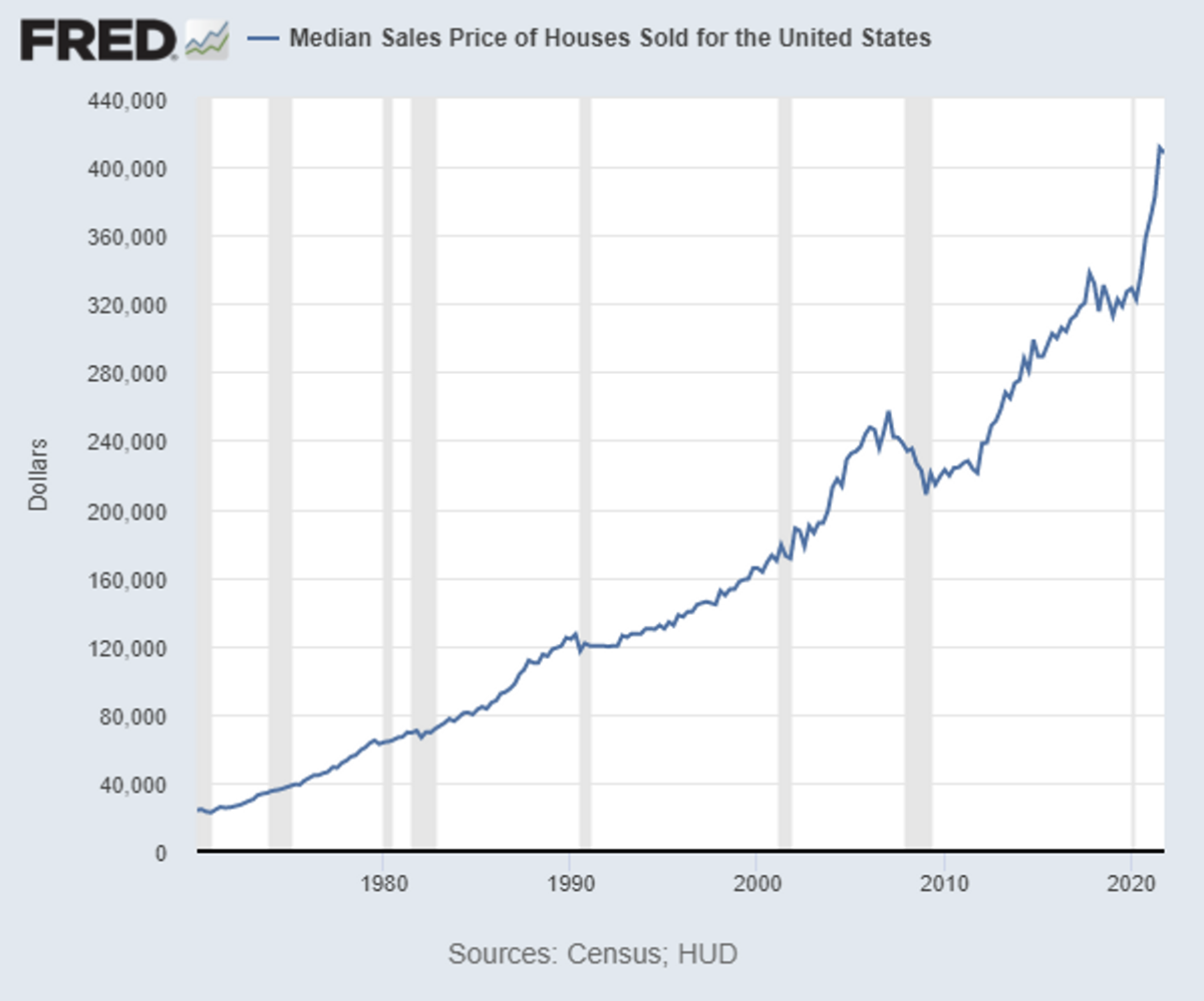

- We know that the national, median home-price has shot up 26.5% over the past two years to an all-time high of $405,000.

- We know that conventional, 30-year mortgage interest rates (the most popular loan terms,) are at their highest level since 2018, and in all likelihood will continue moving north because…

- We know the Fed plans on several more rate hikes this year – possibly SIX. There are growing calls for the next one, in May, to be a 50 basis point hike.

- We know that some economists believe it’s possible we may even see 6% mortgage interest rates this year.

- We know that inflation is the strongest it has been in 40 years, and that economists are beginning to worry that the U.S. may be heading toward a recession.

Despite the above, myself – and many people smarter than me – do not believe we are in a housing “bubble”. This is a fundamentally different marketplace than we experienced in 2008/2009 when the housing market crashed.

Rather, I believe we have experienced “The Great Reset”. Prices will eventually stabilize, perhaps soon, and we’ll inevitably see some price-reductions as sellers find there is less remarkable competition for their homes, but I don’t expect a big pop.

I think we may soon just be reaching a temporary ceiling, is all.

Stabilization is a good thing. The market has been out of whack for almost two years. A lot of people have stayed on the sidelines because they are too intimidated to move. Others have had to agree to terrible terms in order to secure a home purchase – whether in the resale market or new construction. It hasn’t been good for anybody… unless you could sell a house and didn’t have to worry about buying another.

I, myself, am looking forward to the market returning to a normalized pace.

That said, last month was anything but normal. In fact, it was historically insane.

March 2022 Real Estate In Depth…

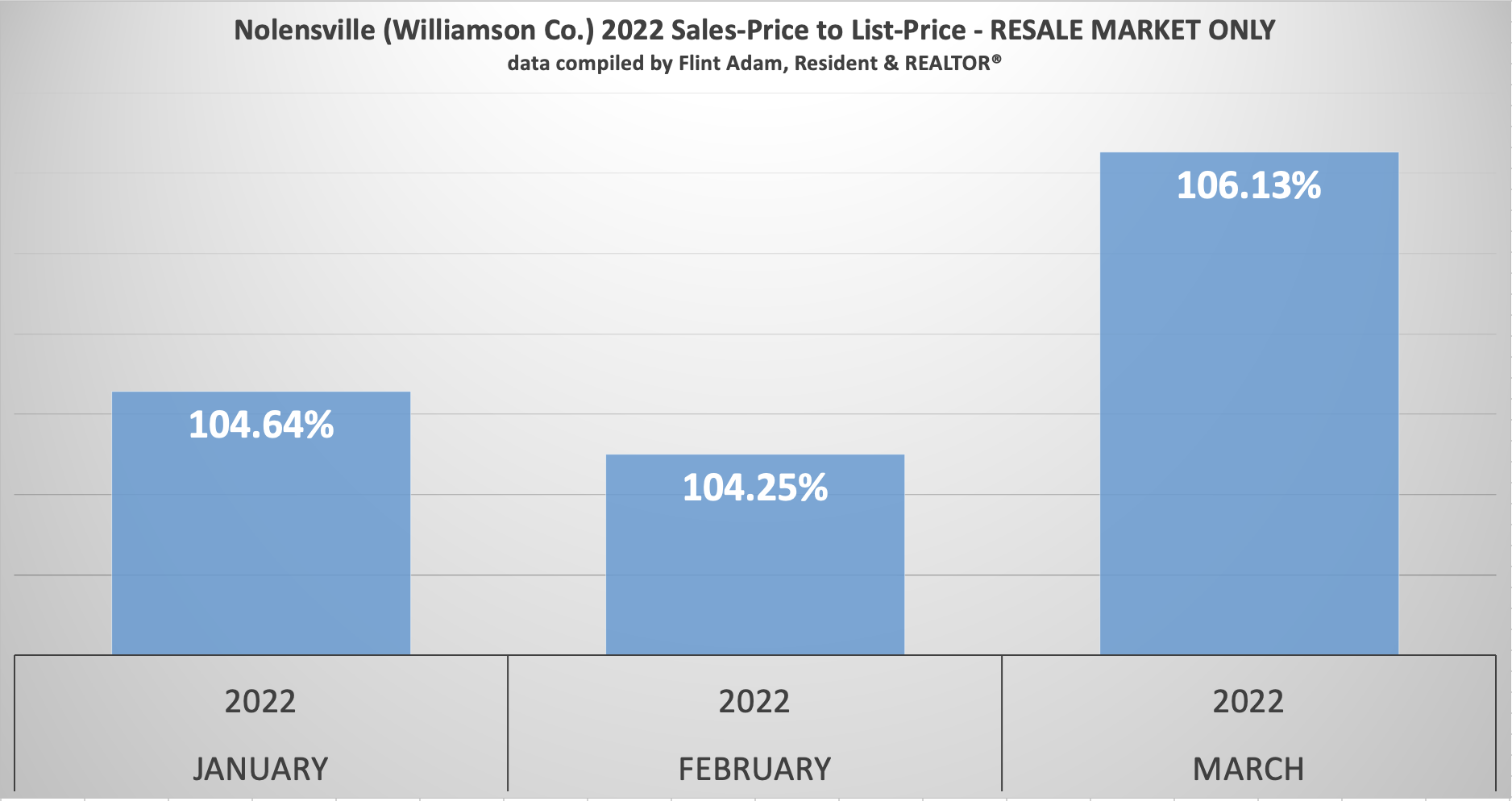

March 2022 bidding wars in the existing homes segment of the market hit heights we have never seen before in Nolensville.

If you purchased an existing Nolensville home last month, you paid more than six percent over asking price, on average. That figure blows away anything we have since the market took off during late winter 2021.

Removing larger-tract properties from the equation and focusing only on subdivision resales yields an even bigger number… 107.09% SP/LP, or more than seven percent above-asking price.

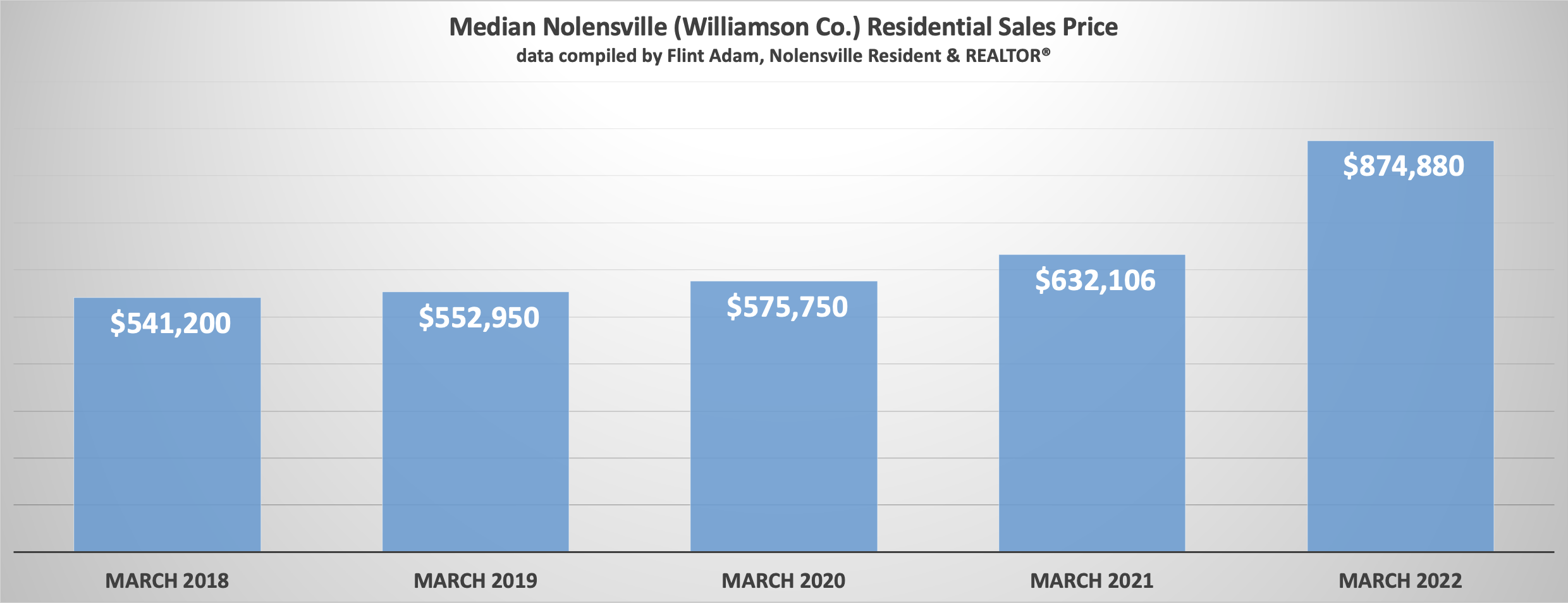

A total of 52 homes sold last month*, which is only one less than the prior March. The median selling price is night and day different, though.

March 2021 is when we first saw aggressive bidding wars lead to massive price gains here in Nolensville, and they have been unyielding since.

But nothing lasts forever, and if anything can take the air out of the room it may possibly be interest rates. I’m interested to see how April plays out. As I review what has closed so far this month I see a mixed bag of homes sold at asking price and others that are, again, preposterously above asking-price.

While there are certainly headwinds, there remains much inertia. Stay tuned.

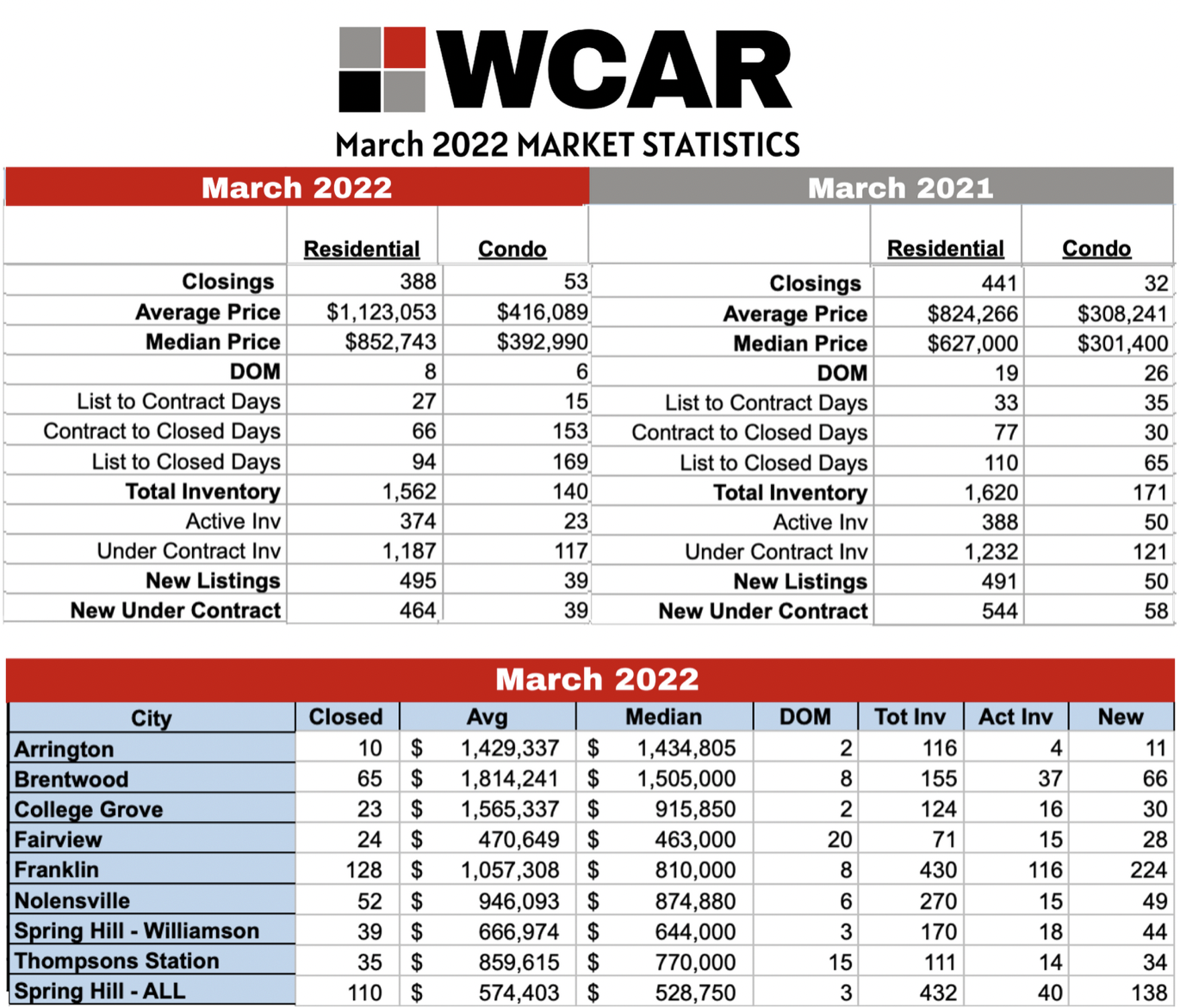

March 2022 vs. March 2021 Nolensville Home Sales:

- 52 Nolensville (Williamson Co.) homes sold… down from 54 (-3.70%)

- The median sales price was $874,880… up from $632,106 (+38.41%)

- The average days on market was 6… down from 17 (-11 days)

- The sales-price to list-price ratio was 103.13%… up from 101.04% (+2.07%)

- 27 of the 52 homes (52%) sold were new construction

- The lowest price sale was 1406 Bluegrass Rd. in Stonebrook for $545,000.

- The highest price sale was 1780 Molly Hollow Road and an accompanying 102 acres sold for $2,415,000.

And here are some of the crazy facts:

- When we eliminate new construction and larger acreage properties and look solely at subdivision resales (21 total), some extraordinary figures come to light:

- The median sales price becomes $755,000

- The average sales-price to list-price ratio grows to 107.09%

- 16 of the 21 sales (76%) are above asking-price… anywhere from $25,000 to $130,000

- The average overage of the above-asking price sales is $68,582

- All-cash purchases make up 14% of sales

- The average days on becomes 2

- 1 of the subdivision resales had a contract fall through before selling

- None of the subdivision resales had to price-reduce before going under contract

*Note: The information above cites Williamson County sales data for Nolensville, Tennessee. There is, of course, a small percentage of Nolensville homes that exist in Davidson and Rutherford counties, but for continuity in my blogging I reference only Williamson County statistics.

Williamson County Sales Stats…

As we moved into spring market, inventory improved as 10% more homes became available for sale in the Williamson County marketplace compared to the month before. However, total inventory lags compared to a year ago.

Active inventory – the number of homes still available for purchase (not under contract) – slightly trailed the March 2021 figure. New listings were about the same, while new contracts fell almost 15% year-over-year. Keep an eye on that figure since it clues us in to what’s happening in the future.

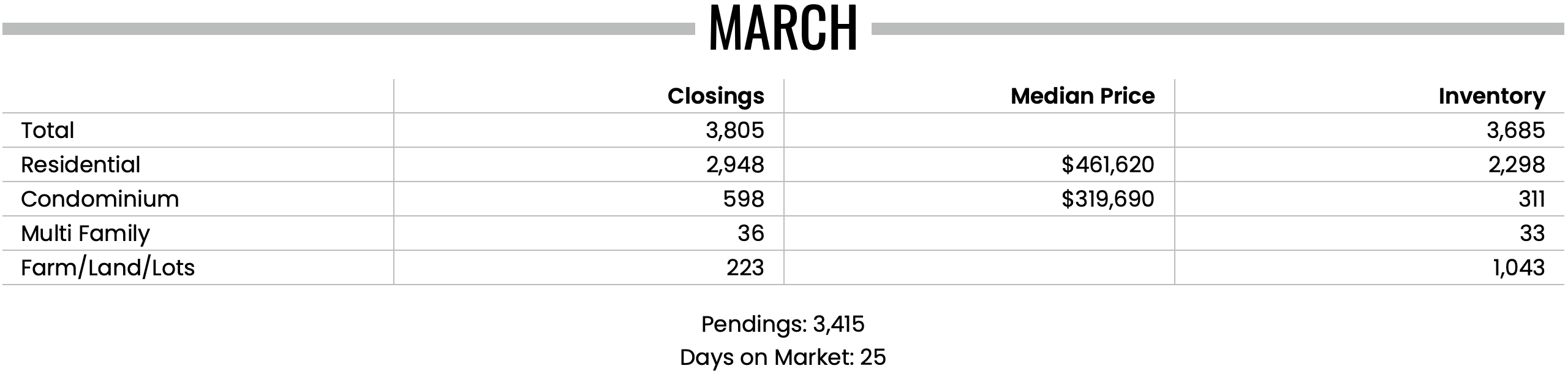

Greater Nashville Sales Stats (includes Williamson Co.)…

Housing inventory across Greater Nashville climbed 9% compared to the month before, and the number of homes sold also rose half a percent compared to March 2021.

Where Does It Go From Here?…

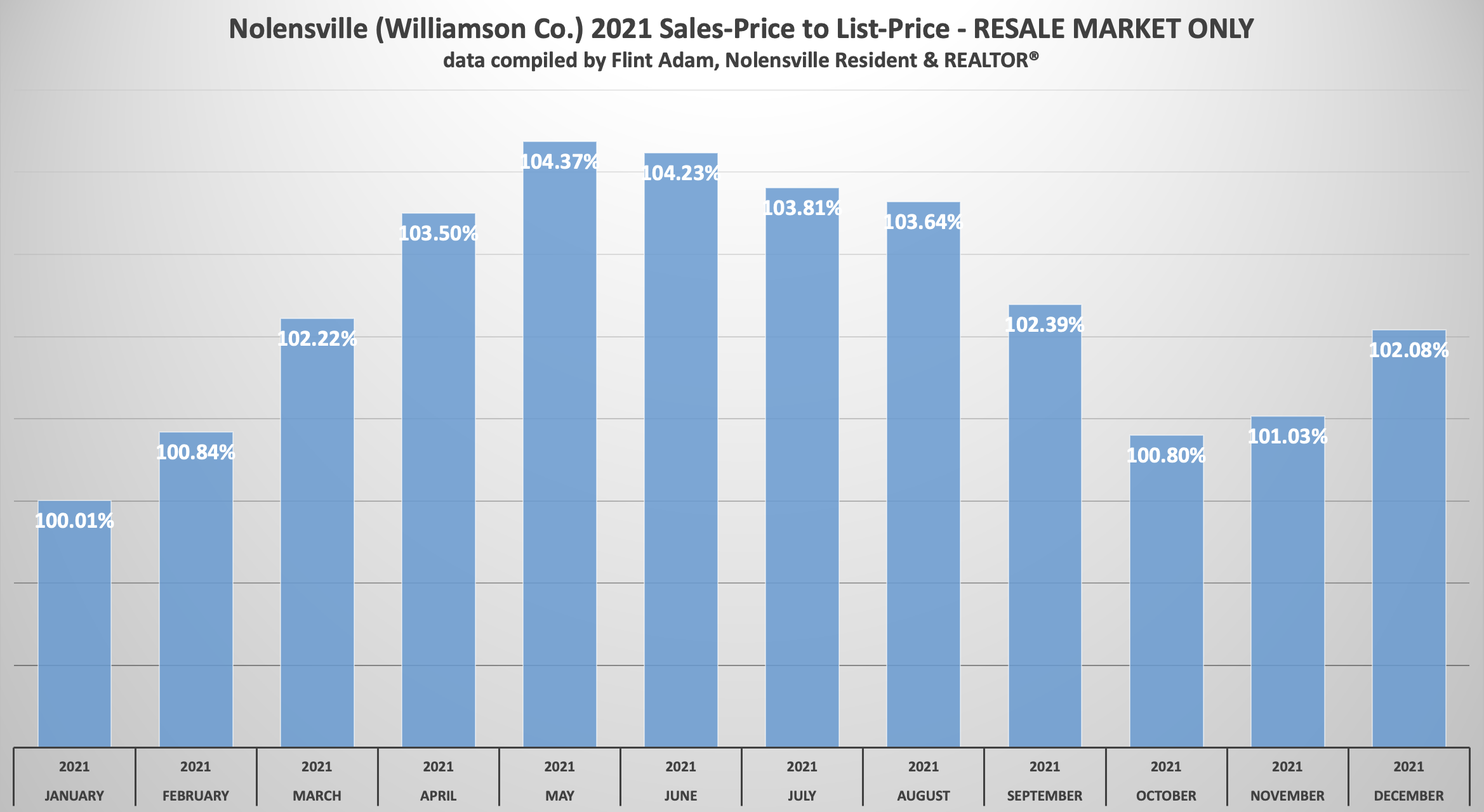

In order for the market to balance, we’re going to need more inventory, fewer bidding wars, and see days on market move back up. Here’s a look at how the existing homes (resale) market in Nolensville (Williamson County) has fared with days on market and SP/LP % over the past decade:

2022 (year-to-date): 8 days on market | 105.13% Sale Price to List Price Ratio

2021: 7 days on market | 102.66% Sales Price to List Price Ratio

2020: 19 days on market | 99.07% Sales Price to List Price Ratio

2019: 30 days on market | 98.4% Sales Price to List Price Ratio

2018: 30 days on market | 98.57% Sales Price to List Price Ratio

2017: 26 days on market | 98.63% Sales Price to List Price Ratio

2016: 33 days on market | 98.70% Sales Price to List Price Ratio

2015: 32 days on market | 98.40% Sales Price to List Price Ratio

2014: 36 days on market | 97.35% Sales Price to List Price Ratio

2013: 42 days on market | 97.64% Sales Price to List Price Ratio

2012: 57 days on market | 97.66% Sales Price to List Price Ratio

If you’re interested in buying or selling, it’s time to talk.

Give me a call at 615-500-6393 or email me at flint@theguidehome.com and let’s chat about your goals. It may be best for you to stay put, and if so – I’ll give you that honest opinion. But if there’s a window of opportunity, I’m going to help you open it right on up.

Interested in up to date Nolensville TN real estate sales figures? I’ll email you an HOURLY UPDATED look at Nolensville real estate activity including what has gone pending, price-reduced, and withdrawn. Just shoot me an email with your name and preferred email address to flint@theguidehome.com

The Latest on Mortgage Rates…

4/13/2022 Commentary by Nolensville resident, Jesse Alvarez, with The Mortgage Exchange

4/13/2022 Commentary by Nolensville resident, Jesse Alvarez, with The Mortgage Exchange

Mortgage rates have officially crossed the 5% threshold. Does this mean that prices will start to level off? Or dare we even dream to think that prices might come down for all the unlucky buyers out there who still can’t find a home?

Well, not exactly. And the truth is, if I really knew the answer to that I would be typing this out from an island somewhere far, far away. I do know that mortgage rates are most likely not done rising and that there is an extreme housing shortage nation wide. That shortage is also worse in the greater Nashville market then it is in most cities. Just remember, most of the large corporations that have announced they are coming to Nashville, haven’t even opened their doors yet. We still have thousands of executives moving to Nashville over the next couple years and they will most likely have Williamson County on their list of school districts that they want to check out. High mortgage rates and extreme inflation probably won’t slow down middle Tennessee too much. Soften is probably the better term to use.

As far mortgage rates go, well I don’t see any good news on that front. The Federal Reserve has made it clear that they need to suppress the demand for goods and services and the only tool they have is higher interest rates. There is talk on Wall Street that mortgage rates could see another 1% to 2% rise before they finally cool off. So the popular opinion is a 6% to 7% mortgage at this time next year. From there, those rates will not begin to come back down until inflation is back around its 2% year over year growth rate or lower. Yesterday the Consumer Price Index came in at +8.4% year over year and today the Producer Price Index came in at +11.2% year over year. With runaway inflation numbers like that, its going to be awhile before the government is able to rein in interest rates.

The big lesson most borrowers are learning from this market, is to not try to time the market or wait for prices or rates to get back to you. Those who have done so are not in a good position right now. If you were waiting to get the type of house you wanted at $700,000 four months ago, you may now find that type of house in that price range in the next month or so. But rates are so much higher that your monthly payment will be the same as if you paid $750,000 on it four months ago with those much lower rates. And if rates continue to rise like they have been, in four more months that $700,000 houses payment will look the same as an $800,000 house payment from December 2021.

Flint Adam is an 11- year Nolensville resident and lives with his wife and children in Bent Creek. He focuses his real estate practice here in town, having served more than 160 buyers and sellers in closed Nolensville real estate transactions. Flint enjoys blogging about local real estate, traveling the world, photography, and hiking. He is passionate about serving Nolensville and keeping it one of America’s greatest small towns.